Regardless of the dicey Q3 reports, there’s a good chance publishers will break off the larger piece of the wishbone this holiday season. While 2023 may hold economic uncertainty and an overall decrease in revenue for marketers, there’s so much to be thankful for as we reflect on the passing holiday. As you feast on the leftovers from your Thanksgiving dinner, sit back, relax, and enjoy this roundup of positive news for publishers.

Although we expected a few industry downturns, advertising revenue still remains strong, even after a tumultuous past two quarters. Even though a majority of publicly traded publishers including Buzzfeed and IAC’s Dotdash Meredith saw a decrease in overall revenue from Q3 2021-2022, there’s a bright side amidst this drop. Publishers are zeroing in on subscriptions, like in the case of Dow Jones, which was able to increase its total circulation revenue, with 68% accounting for digital subscriptions. By the looks of it, this revenue stream is only going to keep growing.

* Q3 2021 revenue figures are pro forma to include revenue from Complex Networks, Meredith and The Athletic, respectively, in order to provide comparable pre-acquisition figures.

** News Corp's Dow Jones total revenue reflects the three months ending on Sept. 30, 2022, which is considered the first quarter of the company's fiscal year.

This positive outlook means big things are ahead, especially since digital produces 66.8% of new starts in subscriptions compared to 33.2% of print products. Paid, digital subscriptions may present a slight challenge for print revenues working to keep up, but this medium still represents 55.9% of total paid subscriptions. It’s likely that publishers will double down on their investments in 2023.

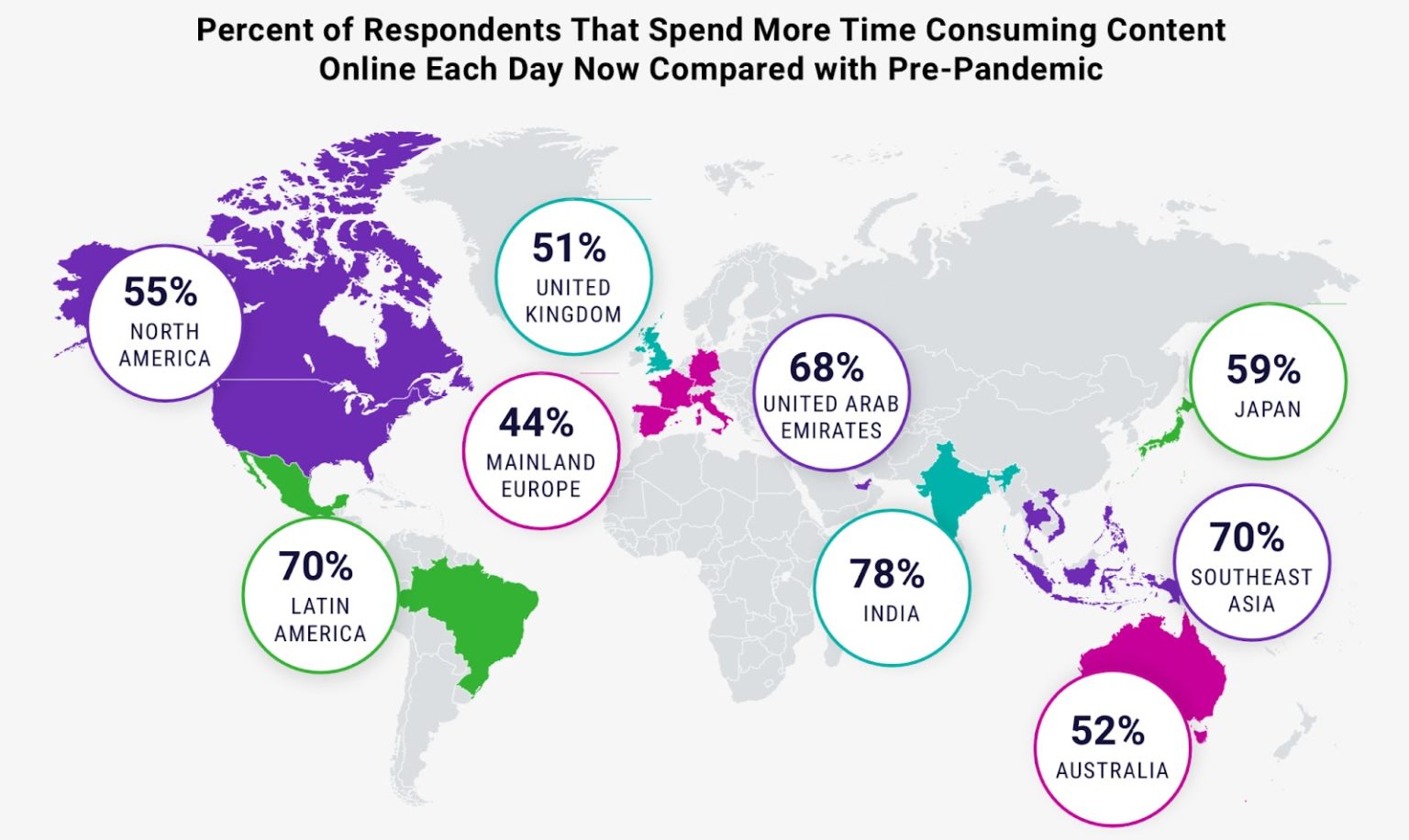

One thing that will help propel this shift in content is the staggering growth of digital consumption worldwide. Based on findings from over 16,600 consumers across 18 countries, the data and analytics platform DoubleVerify confirmed that 55% of people spend more time-consuming content each day than they did prior to the pandemic. Considering more than 27% of consumers are expected to spend additional time on social media next year, publishers will have to consider new, exciting ways to play, and win, the attention game with online users.