Your product is your baby, so you should know it from top to bottom, right?

Obviously. But there’s one thing that you can’t be sure of until you get it out in the market…

And that is, the person you’re actually targeting. Even if you do know your target audience, how do you make data-driven decisions?

And to obtain that data, Brooke Osmundson recommends collecting market intelligence.

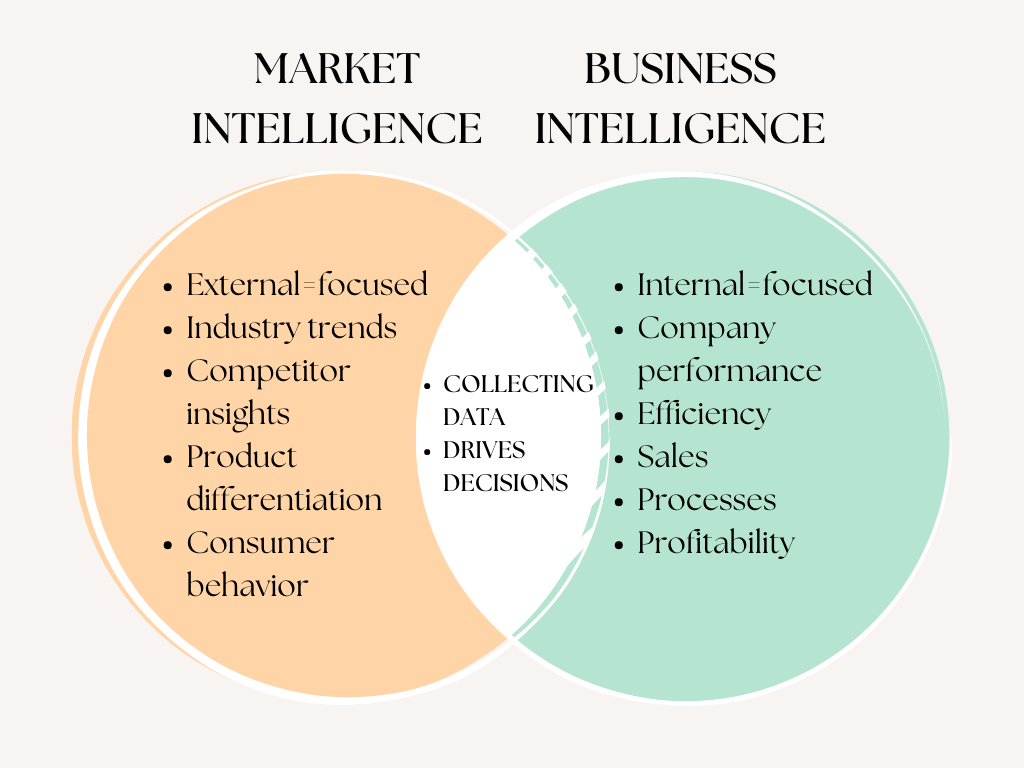

Market intelligence focuses on external factors like behavior, pricing data, customer surveys, etc., to align your goals, relocate budgets, and advertise better.

You can break down market intelligence analysis into different categories:

- Competitor trends. Identifying your strengths and weaknesses, plus key product differentiators or similarities compared to your rivals to help you position your product.

- Consumer behavior trends. Finding your ideal customers by looking at interests, how they spend time and money, their browsing and shopping behaviors, etc.

- External market factors. Identifying the pros and cons of your current market, helping you make calculated risks, expanding to different markets, and similar.

All good. Now, how do you go about gathering market intelligence?

First, set up a goal. Think about what you want to answer. Do your potential customers know about your product? Do you need to reallocate budgets? What are competitors doing?

Second, define metrics. What numbers matter to your business? Is it total addressable market share, or expected growth rate?

Or maybe it’s knowing how your prices compare to your rivals’ prices, or how many competitors are in the market, etc.

Finally, it’s time to collect. You can get data from various sources, including:

- Your own customers. Survey them about their pain points, feedback, and suggestions.

- Analytics databases. Combining your first-party analytics data with third-party tools can provide a clear picture of key differentiators.

- Online research. Reviewing business journals and reports that are specific to your market.

- Market experts. Hiring consultants that are “in the trenches” and understand the inner workings of a particular market. They can command a hefty fee, though.

That should set you up nicely and help you in your journey. So gear up and get going!